The Secret to success in any field is to find what successful people do, think about and act on, and do the same – Anthony Robbins

I started Stock and Ladder with the intention of seeking answers to a key question pertinent to every single investor – How do we invest better?

Since 1998, when I first learned about Security Analysis and Portfolio Management as part of my MBA curriculum, I have been fascinated by the world of investing in general and by stock markets in particular.

Post my MBA, once I began my actual investing journey, I quickly understood the wisdom behind Warren Buffett’s wise words “I did be a bum on the street with a tin cup if the markets were always efficient”.

It clearly dawned on me that the actual world of investing is quite different from the one I was expecting it to be [based on my MBA textbooks]. In my quest to find some real-world answers on “What works in Investing”, I swapped the studying of academic textbooks with the reading of investment classics written by successful super investors.

This helped me find my answers and also showed me the way forward.

Studying Superinvestors

It seems logical that even before thinking of buying any common stock, the first step is to see how money has been most successfully made in the past” – Phil Fisher

The smartest, the brightest and the most successful investors’ a.k.a. “Superinvestors” have each spent a lifetime in investing, in reading and in thinking for gaining their investing wisdom on “what works in investing” and have used different investing strategies and styles to achieve investment success.

Looking at the careers of the great investors, it is clear that there are many different, often contradictory, ways to succeed. Each has been highly successful in his own way” Roy Neuberger

Warren Buffet when quizzed about Peter Lynch’s wide diversification strategy put the point eloquently “I’ve said in investing, in the past, there’s more than one way to get to heaven”. Similarly, each one of these different investing strategies and styles have been used by superinvestors to successfully make money in the stock market.

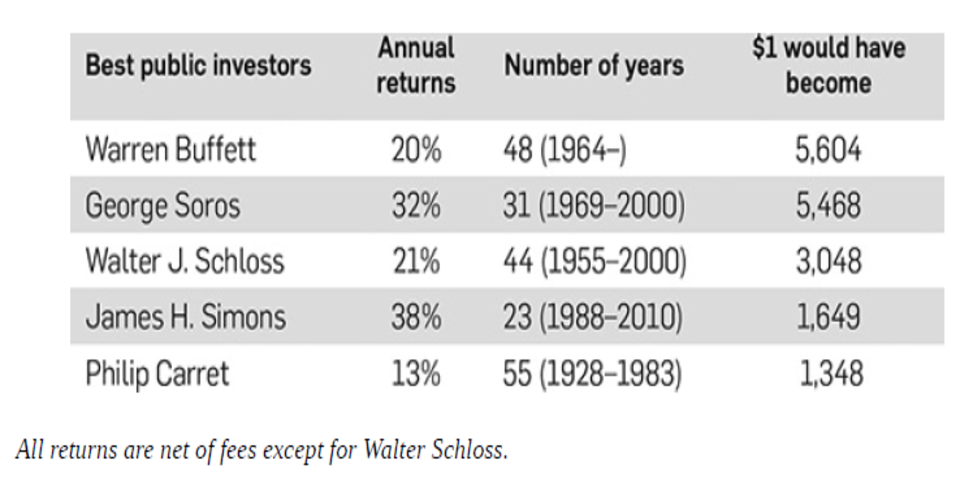

The below table shows what one dollar’s worth of initial capital would have ultimately been worth if you would have invested with these great investors from the beginning:

[Source: The World’s 99 greatest Investors]

This table wonderfully highlights the long term track record of investing out-performance achieved by these superinvestors. This is also a clear validation that these strategies are markets proven actionable pieces of investing wisdom and not mere pieces of academic information.

Logically then, the simple yet smart thing to do for normal investors like you and me is to study the successful strategies (investing wisdom) of these Superinvestors and apply their wisdom to our own investing.

Our life is too short for us to spend it on reinventing the “investing” wheel or in trying to learn investing by committing all the mistakes oneself.

The Stock and Ladder Way

Charlie Munger put it brilliantly-

I believe in the discipline of mastering the best that other people have ever figured out. I don’t believe in just sitting down and trying to dream it all up yourself. Nobody’s that smart”.

Analyze, Adapt and Apply

Analyze the strategies of the successful superinvestors and learn from their success and mistakes. This will make you aware of what has worked in investing in the past along with the tools and techniques used for achieving the success.

The next key thing to do is to “Adapt” this investing wisdom to suit your specific individual scenario and then apply this adapted strategy to your investing.

Do not blindly copy, clone or coattail the superinvestors strategy. Adapt the strategy (wisdom) to suit your temperament, your investing objectives, your investing resources, your skill set and your competencies. These are bound to be different from any of the superinvestors you wish to emulate.

Why Adapt

A 17th century Japanese poet, Matsuo Basho put it beautifully:

When journeying upon the path of wisdom, do not seek to follow in the footsteps of the wise. Seek what they sought. Seek the meaning behind their footsteps, and not upon the steps themselves.

For in seeking the footsteps you shall be glancing only upon the next footprint. And you’re sure to stumble upon an unforeseen obstacle. But in seeking the meaning behind their footsteps you’re sure to see ahead; comparable to looking up while walking.

Thus, allowing you to easily maneuver around the hurdles on the path you walk. …And if you walk like this long enough, you’ll one day, to your surprise, find yourself among the wise.

Final Thoughts

The title of this post “Smart money studying superinvestors” is also the tagline of the Stock and Ladder web site and its key focus area going forward. The motto being:

“Study from Masters, Adapt from Masters, Become the Master”

In the coming days, I intend to share here the investing lessons, successes, mistakes, ideas and insights got from studying these superinvestors.

Hopefully each one of us will adapt this wisdom to suit our individual temperament and our available resources thereby charting our own unique path to investment success.

Keep Learning, Happy Investing.

Liked what you have read? Subscribe to get the latest posts delivered for FREE directly into your inbox.

Love Reading? Check out the best books to read at the Superinvestors Bookshelf

Let’s stay connected, Follow me on Twitter @Stocknladdr

Terms of Use: Read Disclaimer

Relate Posts

Do you love Reading?

Check out the best books to read at the Superinvestors Bookshelf Let’s stay connected, Follow me on Twitter @Stocknladdr