To me, it’s obvious that the winner has to bet selectively” – Charlie Munger

This post is inspired by this tweet from Ian Cassel. It made me remember the above quoted Munger’s prophetic words and also made me revisit a question which I had debated a lot within myself during the initial phases of my investing journey.

The Tweet:

“The longer I invest the more I realize you get 1-2 really great opportunities every few years. The rest of the time is spent wondering if you will ever get another great opportunity again and convincing yourself to own mediocre opportunities while you wait.” – Ian Cassel

The Question:

Do you chase many mediocre opportunities in the market and bet frequently or search for few great opportunities and bet selectively?

High Conviction ideas and Alpha

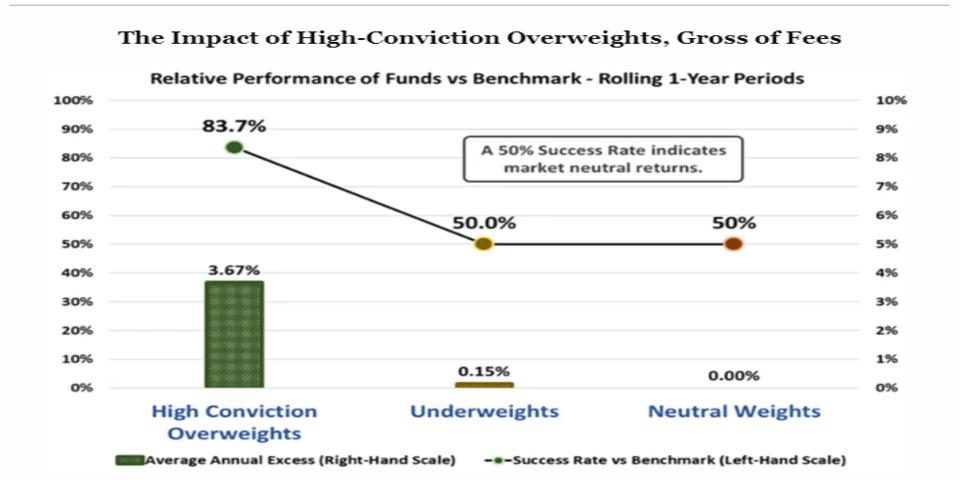

An excellent research study recently explored how active managers generate stock-selection alpha. The study involved a multi-year analysis covering 114 US equity mutual funds from 57 fund families and evaluated more than 400,000 individual rolling one-year performance periods.

The objective was to examine the correlation between the fund Manager’s conviction for an investing idea and the alpha the fund generated. The findings were pretty interesting but in hindsight not totally surprising:

“High-Conviction Overweights (ideas) are the sole category through which active managers could add alpha. High-Conviction Overweights achieved success rates of 84% gross of fees and 74% net of a theoretical 85 basis points (bps) fees. Underweights and Neutral Weights, by comparison, generated a success rate of 50% gross of fees — the equivalent of a pure beta portfolio — and materially inferior success rates after fees “

Simply put, this questions the conventional wisdom on the portfolio construction process and implies that

- High conviction ideas must be the ONLY focus for actively managed funds.

- Any allocation to lesser conviction ideas to take care of the “Beta” of the portfolio results in the loss of alpha leading to dilution of the returns.

This begs the question for an active investor: Do you really believe that every single day we can come up with a great investing idea which is unique and contrarian ? Highly unlikely.

In the absence of a crisis, great investing ideas / opportunities are very rare and you generally get one or two of them in a year. Many good ideas can only be a poor substitute for a single great idea. Yet we want some “action” in the market every single day and many times we end up placing bets on even moderately good ideas. Why ?

The possible reasons :

- Need for “action” or seen doing something

- No one is sure when the next great opportunity will come and / or how big it will be

- Professional fund management compulsions

- Sitting on Cash on the sidelines without swinging your bat is nerve wracking

- Not many have the luxury to sit all day long “reading” (working)

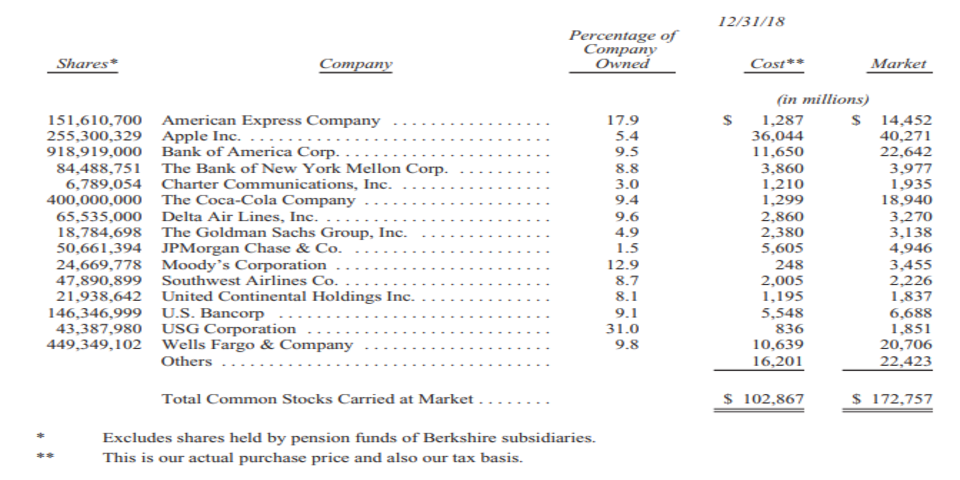

Quoting Buffett is a cliché but many times its the most appropriate. If you think that you would need a large number of investing bets because you have a big corpus then spare a minute to have a look at Warren Buffets investments in marketable securities.

Around 85% of his USD 170 billion worth investments are concentrated in just 15 securities. By betting selectively on few great ideas, Buffett has made a fortune.

The research study also highlighted this fact that investing only on our high conviction ideas and consciously avoiding mediocre lower conviction ideas will do wonders to our portfolio returns and our investing career.

What then does it take to follow this investing approach? The answer, I believe, lies in these 5 C’s .

5 C’s of selective betting

-

Competence: The skill required to find great ideas.

You cannot become a great Pastry chef if you don’t know how to bake. Similarly, if you are going to bet selectively on great ideas then you should firstly be competent enough to identify one.

-

Cash: Adequate Funds to back the great ideas

What is the use of a great idea if it cannot be backed by adequate funds. Allocate too little and you cannot really feel the impact. Allocate too much and your portfolio can get wiped off. Always back great ideas with materially significant allocation which is neither too little or too much

-

Conviction: High confidence in your idea

When you bet, place your stakes on an idea on which you have the highest conviction. The one which you believe has the best chance of success backed by research, data and thought.

Betting selectively in great ideas only requires a bundle of confidence. Confidence is needed in your investing process, in your investing strategy and most importantly in – YOURSELF

-

Courage: Courage in times of crisis.

Great opportunities come usually when there is a crisis or what you say as “when there is blood on the street”. Also there could be great opportunities when outstanding companies are going through a temporary problem. Courage to back up your great ideas during crisis is priceless.

-

Character: Ability to say “No”

Last but certainly the most important “C” is your “character” – your basic nature, trait and mental make-up.

Similarly, for an investor, the ability to say “No” is a tremendous advantage. When your friends and colleagues are caught in the market frenzy, maintaining a Zen level of calmness and not biting at every cookie thrown at you requires a great temperament. Sitting on cash without hitting the buy requires character.

Final thoughts

Peter lynch famously said “Owning Stocks is like having children, don’t get involved with more than you can handle”.

Every time you hit the “buy” button you are not just allocating your money to your idea but also giving something even more precious and irreplaceable of yours- TIME.

To answer the question with which we began, Whether you should bet selectively on few great ideas or bet frequently on many moderately good ideas; it all comes down to one thing – YOU.

Do you have the 5 c’s needed to make this strategy work? If yes then give this very successful strategy a try and start betting selectively. on great ideas. That’s what winners do !!!

Do you love Reading? Check out the best books to read at the Superinvestors Bookshelf

Let’s stay connected, Follow me on Twitter @Stocknladdr

Terms of Use: Read Disclaimer

Relate Posts

Do you love Reading?

Check out the best books to read at the Superinvestors Bookshelf Let’s stay connected, Follow me on Twitter @Stocknladdr